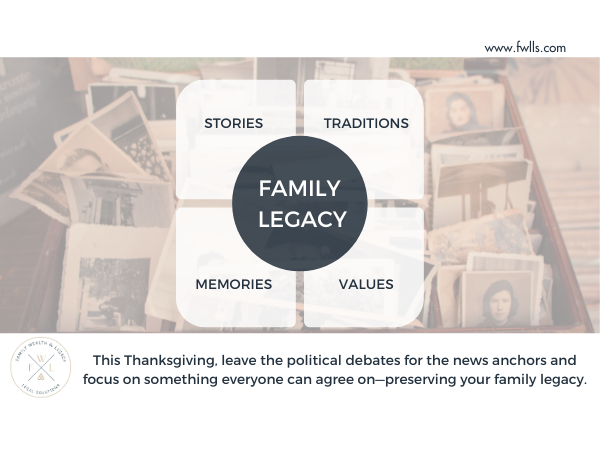

Thanksgiving offers a meaningful opportunity to reflect on your family’s legacy and start conversations that can shape your family’s future for generations to come. This year, as you gather to celebrate, please consider some tips and traditions from an estate planning and family law attorney, so you can set the stage to go beyond the meal, or political argument, and try to get to the heart of what matters most — your family’s history, stories, values, and legacy.